IA Form 104 2013-2024 free printable template

Show details

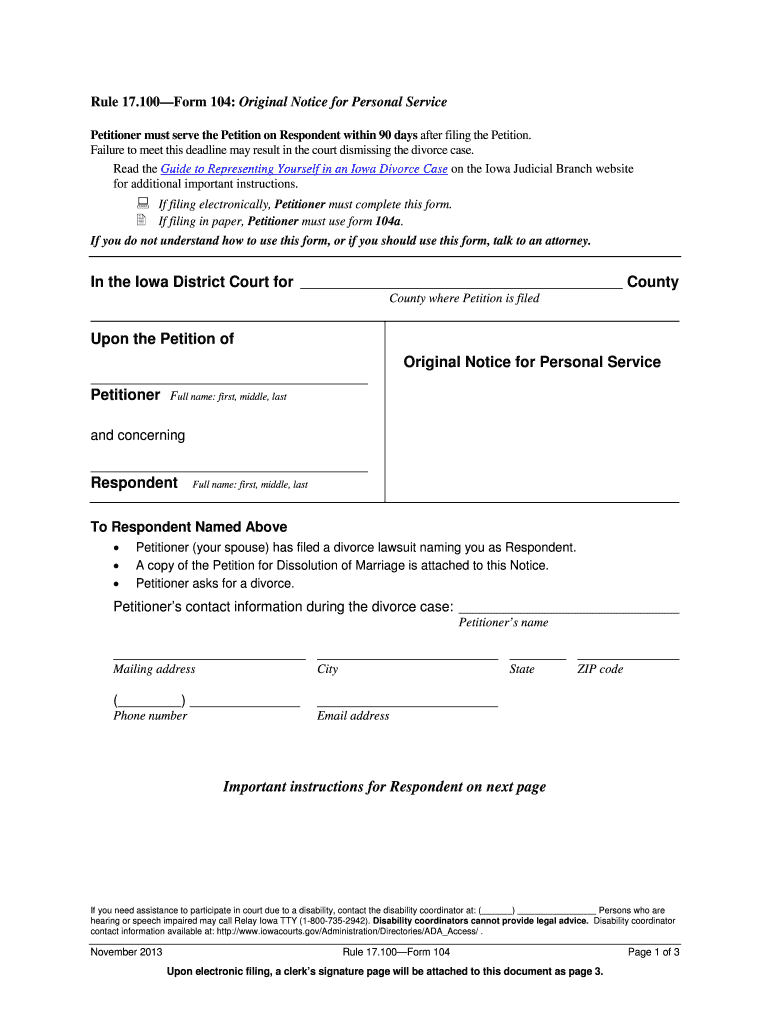

Rule 17. 100 Form 104 Original Notice for Personal Service Petitioner must serve the Petition on Respondent within 90 days after filing the Petition. Failure to meet this deadline may result in the court dismissing the divorce case. Read the Guide to Representing Yourself in an Iowa Divorce Case on the Iowa Judicial Branch website for additional important instructions. Rule 17. 100 Form 104 Original Notice for Personal Service Petitioner must serve the Petition on Respondent within 90 days...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your iowa 104 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa 104 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iowa 104 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit iowa form 104 for divorce. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out iowa 104 form

How to fill out Iowa 104:

01

Gather all necessary information and documents such as your income statements, deductions, and credits.

02

Carefully read through the form's instructions to ensure you understand the requirements and guidelines.

03

Fill out your personal information including your name, address, and Social Security number.

04

Report your income accurately by entering the appropriate amounts in the designated sections.

05

Deduct eligible expenses or credits, ensuring that you provide all necessary supporting documentation.

06

Double-check your entries, making sure all calculations are correct and all required fields are completed.

07

Sign and date the form, and include any other requested information or attachments, if applicable.

Who needs Iowa 104:

01

Individuals who are residents of Iowa and have earned income within the state during the tax year.

02

Non-residents who have earned income in Iowa and are required to file a state tax return.

03

Anyone who has income from Iowa sources and needs to report it for tax purposes, regardless of residency status.

Video instructions and help with filling out and completing iowa 104

Instructions and Help about iowa 104 original notice form

Fill iowa 104 form : Try Risk Free

People Also Ask about iowa 104

What is a form IA 1040?

Do I need to file an Iowa income tax return?

What is the Iowa low income exemption?

How many allowances should I claim in Iowa?

How do I qualify for farm tax exemption in Iowa?

Who must file an Iowa non resident tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is iowa 104?

Iowa 104 refers to a highway in the state of Iowa, United States. It is designated as Iowa Highway 104, also known as IA 104. The highway runs for approximately 11 miles between the cities of Hampton and Latimer in Franklin County.

Who is required to file iowa 104?

Any individual who is an Iowa resident or has Iowa-source income is required to file Iowa Form 104.

How to fill out iowa 104?

To fill out Iowa Form 1040, follow these steps:

1. Gather all necessary paperwork: You'll need your W-2 forms, 1099 forms, and any other documents that report your income or deductions.

2. Download or obtain Form 1040: You can find the form on the Iowa Department of Revenue's website or request a copy from their offices.

3. Personal information: Fill in your name, Social Security number, and contact information at the top of the form.

4. Filing status: Choose your filing status (e.g., single, married filing jointly, etc.) and enter it in the appropriate box.

5. Income: Report all sources of income including wages, salaries, tips, self-employment income, interest, dividends, retirement income, etc. Use separate lines or additional schedules if necessary.

6. Deductions and exemptions: Calculate and report any deductions or exemptions you qualify for on the designated lines. These include standard deductions, itemized deductions, and any specific Iowa deductions.

7. Tax liability: Use the provided tax rate table or tax calculation worksheet to determine your tax liability based on your income and filing status. Enter this amount on the appropriate line.

8. Credits and payments: Report any eligible tax credits you qualify for on the designated lines. These could include the Child Tax Credit, the Earned Income Credit, or other applicable credits. Also, report any previous tax payments made, such as estimated tax payments or withholding.

9. Refund or balance due: Calculate the difference between your tax liability and any credits/payments. If you're due a refund, enter the amount on the appropriate line. If you owe a balance, include payment with your return or set up a payment plan with the Iowa Department of Revenue.

10. Sign and date: Sign and date the form at the bottom to certify its accuracy. If filing jointly, both spouses must sign.

11. Attach necessary forms: Attach any additional forms or schedules required to support your income, deductions, or credits. Verify if you need to include copies of your federal return or other documentation as well.

12. Make a copy: Make a copy of the completed form and all attachments for your records.

13. Mail your return: Mail the completed form and any payments to the Iowa Department of Revenue at the address listed on the instructions. Make sure to use the correct mailing address based on your payment type and whether you're enclosing a payment or expecting a refund.

It's crucial to consult the instructions provided with the form and review them thoroughly to ensure accuracy and compliance with Iowa tax laws.

What is the purpose of iowa 104?

Iowa 104 does not have a specific or widespread purpose. "Iowa 104" likely refers to a state highway in Iowa, which connects different cities or areas within the state. Its purpose is to facilitate transportation and provide a route for motorists to travel from one location to another in Iowa.

What information must be reported on iowa 104?

The Iowa 104 form, also known as the Iowa Individual Income Tax Return, requires the reporting of various information related to an individual's income, deductions, and tax liability. The specific information that must be reported on the form includes:

1. Personal information: Name, address, Social Security number, and filing status.

2. Income: All sources of income must be reported, such as wages, salaries, tips, self-employment income, rental income, investment income, unemployment compensation, and any other taxable income.

3. Adjustments to income: Certain deductions can be claimed, such as contributions to traditional IRA or health savings accounts, alimony paid, etc.

4. Iowa itemized deductions or standard deduction: Taxpayers can choose to itemize their deductions or claim the standard deduction, whichever is more beneficial.

5. Iowa tax credits: Any eligible tax credits should be reported, such as the child and dependent care credit, education tax credit, earned income tax credit, etc.

6. Tax payments and withholding: Report any Iowa state income tax already paid through withholding from wages, estimated tax payments, or any refund applied from the previous year.

7. Iowa income tax calculation: Calculate the tax liability based on the income, deductions, and credits reported.

8. Tax due or refund: Determine if there is an outstanding tax balance or if a refund is owed.

It is important to note that the instructions and guidelines provided with the Iowa 104 form should be thoroughly reviewed to ensure accurate reporting of all required information.

When is the deadline to file iowa 104 in 2023?

The deadline to file Iowa Form 1040 for tax year 2023 is April 30, 2024. However, please note that tax deadlines are subject to change, and it is always advisable to verify the exact deadline with the Iowa Department of Revenue or a qualified tax professional closer to the tax season.

What is the penalty for the late filing of iowa 104?

The penalty for late filing of Iowa Form 104, also known as the Iowa Individual Income Tax Return, depends on the amount of tax owed and the duration of the delay. The general penalty for late filing is 10% of the tax due per month, or part of a month, up to a maximum of 50% of the tax due. Additionally, interest is charged on any unpaid tax at a rate of 8% per annum. It is important to note that specific penalty and interest calculations may vary based on individual circumstances, so it is recommended to consult the Iowa Department of Revenue for accurate and up-to-date information.

How do I make changes in iowa 104?

The editing procedure is simple with pdfFiller. Open your iowa form 104 for divorce in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the original notice in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your iowa 104 online and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete gov tax on an Android device?

Complete your original notice form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your iowa 104 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Original Notice is not the form you're looking for?Search for another form here.

Keywords relevant to iowa notice personal service form

Related to iowa personal service

If you believe that this page should be taken down, please follow our DMCA take down process

here

.