IA Form 104 2023-2025 free printable template

Show details

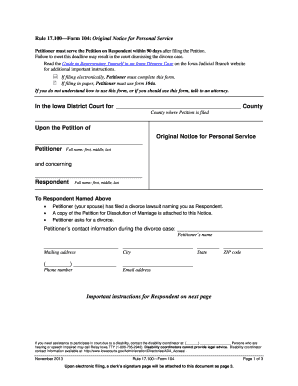

This document serves as an official notice to the respondent in a divorce case, informing them of the lawsuit and their rights and responsibilities regarding the legal proceedings.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA Form 104

Edit your IA Form 104 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA Form 104 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IA Form 104 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IA Form 104. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA Form 104 Form Versions

Version

Form Popularity

Fillable & printabley

Instructions and Help about IA Form 104

Fill

form

: Try Risk Free

People Also Ask about

What is a form IA 1040?

IA 1040 Individual Income Tax Return, 41-001. Page 1.

Do I need to file an Iowa income tax return?

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers.

What is the Iowa low income exemption?

If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your net income from all sources, line 26, is $9,000 or less and you are not claimed as a dependent on another person's Iowa return ($24,000 if you are 65 or older on 12/31/22).

How many allowances should I claim in Iowa?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How do I qualify for farm tax exemption in Iowa?

Iowa Family Farm Tax Credit Eligibility: All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if contiguous to qualifying land of more than 10 acres. The owner or designated person must be actively engaged in farming the land.

Who must file an Iowa non resident tax return?

You were a nonresident or part-year resident and your net income from Iowa sources [line 26, IA 126 (pdf)] was $1,000 or more, unless below the income thresholds above.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IA Form 104 for eSignature?

When you're ready to share your IA Form 104, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit IA Form 104 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing IA Form 104 right away.

How can I fill out IA Form 104 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IA Form 104 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is rule 17100form 104 original?

Rule 17100 Form 104 Original is a specific tax form used for reporting income, deductions, and other financial information to tax authorities, primarily within a certain jurisdiction, as mandated by local tax regulations.

Who is required to file rule 17100form 104 original?

Individuals and businesses that meet specific income thresholds or who have certain financial activities that require reporting under jurisdictional tax rules are obligated to file Rule 17100 Form 104 Original.

How to fill out rule 17100form 104 original?

To fill out Rule 17100 Form 104 Original, taxpayers should gather their financial documents, follow the instructions provided with the form carefully, complete sections on income, deductions, and credits, and ensure all necessary documentation is included before submission.

What is the purpose of rule 17100form 104 original?

The purpose of Rule 17100 Form 104 Original is to enable tax authorities to assess an individual's or business's tax liability accurately, ensuring compliance with local tax laws.

What information must be reported on rule 17100form 104 original?

Rule 17100 Form 104 Original typically requires the reporting of personal identification information, total income, deductible expenses, tax credits, and other relevant financial details that affect the tax calculation.

Fill out your IA Form 104 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA Form 104 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.